How was President Andrew Jackson able to eliminate U.S national debt in 1835?

score:8

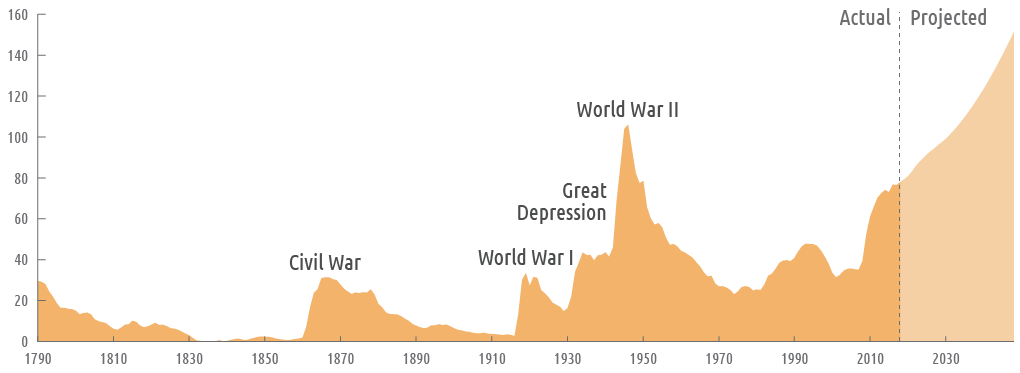

The US national debt, as a percentage of the economy, was rather minuscule at the time compared to what it is today, so the two situations and their takeaways aren't really comparable:

Upvote:4

Jackson was able to do this because he wanted to. "Where there's a will, there's a way." Although he built on the accomplishments of his predecessors.That would be a good lesson for today's U.S. government,which seems to lack the will to do anything.

But as Denis' excellent graph points out, it was not hard, because Jackson inherited a small debt, held mostly by foreigners. He paid it off because he didn't want them interfering with his plans described in the next paragraph.

In pursuing his "pet" project (pun intended), the so-called "pet banks", Jackson was pursuing the "Jeffersonian" model of a decentralized economy and banking system. This was in contrast to the "Hamiltonian" model of a strong central government, including a strong central bank. One of Jackson's claims to fame was his fight with banker Nicholas Biddle over this matter. Jackson's victory set back the creation of the U.S. Federal Reserve Bank by 80 years (from 1833-1913).

The "pet banks" were high on the wish list of Jackson's key supporters (many of them got to be presidents of these small banks). I don't know if he actually did this, but I can easily imagine him telling them, "Help me clean up the national debt, and I'll give you the banking system you want."

The "mechanics" are described here.

Upvote:8

Mostly he was elected when it was about to happen, and didn't stop it.

If you look at the history of US Debt vs GDP, you'll see a fairly clear pattern of event-based upward spikes (colored blue below), followed by periods of slow decline (colored red).

Looking this over, its pretty easy to spot the big drivers. All of them are sudden spikes coincident with either wars or big money-supply-induced recessions, with two exceptions: the Reagan Era, and the presidency of George W. Bush.

In every case (with those two exceptions) the debt percentage dropped slowly towards 0 until the next spike hit.

Jackson in particular happened to be voted into office right near the 0 point. You could give him credit for not using the occasion to go on a Regan/Bush style spending spree*, but that's probably all the credit he really deserves.

* - I distinctly remember the talk during the early Bush (II) administration that we were on a trajectory to effectively pay off the debt for the first time since WWII. Rather than let that happen, a very large tax cut was passed, as well as a pretty big Medicare drug expansion. Then the Great Recession came along and blew everything out of the water...

More post

- 📝 At Pearl Harbor was a Japanese Third Wave of attack in the original plan or was Nagumo expected to improvise?

- 📝 Researching a Spanish document from the ~XV century

- 📝 In the "Christmas truce" of 1914 were there any football (soccer) matches between British and German troops?

- 📝 How did the Russian-American Company respond to employee desertion?

- 📝 British Warships and Their Crew In Hawaii in the Mid-1800s

- 📝 How severe was the 1943 Bengal Famine?

- 📝 What happened first? The law that authorized the Cuban government to nationalize US firms or Eisenhower's Cuban sugar quota?

- 📝 How were the modern countries in South America formed?

- 📝 How was debt handled in the change over from the Julian calendar to the Gregorian?

- 📝 Why did the British scuttle the u-boats surrendered after WWII?

- 📝 Why were so few Koreans enlisted in the Japanese Army before conscription was introduced in 1944?

- 📝 Why didn't Thailand have to pay more for its involvement in WW2?

- 📝 Did the Axis engage in trade with other countries during the war?

- 📝 What was the population of the Parthian Empire around (AD) 1 CE?

- 📝 Have there been other examples of reunification/annexation, such as in the Crimea, that succeeded without using deadly force?

- 📝 Are there thirteenth century sources linking the Fifth Crusade to the Book Of Daniel?

- 📝 When and where was William the Conqueror baptized or christened?

- 📝 Khagantes, Aghas, and Sultanates, a feudalism of the east?

- 📝 Did Frederick Douglass affect British policy during the American Civil War?

- 📝 Why is German spoken in Upper Valais?

- 📝 Are Chinese and Iranian "blocky" writing styles related?

- 📝 How frequently were heated metal torture implements used?

- 📝 Oldest appearance of "brand names" in history?

- 📝 Was the Taiping Rebellion the deadliest war of the 19th Century?

- 📝 Who was the prime leader of the Maratha Confederation?

- 📝 What is this medal that LBJ is wearing?

- 📝 What was the population of the Roman Empire?

- 📝 Etymology of Pine Street in San Francisco

- 📝 What is the 'rank switching' done by Roman Legionnaires in HBO's 'Rome' called, and did it actually happen?

- 📝 Why did Nazis burn 628 Belarusian villages to the ground?

Source: stackoverflow.com

Search Posts

Related post

- 📝 How was President Andrew Jackson able to eliminate U.S national debt in 1835?

- 📝 Did the U.S economy flourish after national debt was eliminated by President Andrew Jackson in 1835?

- 📝 How was Germany able to hold itself together, while Austria-Hungary could not?

- 📝 How was the United States able to produce excellent tanks in 1942?

- 📝 How was the Luftwaffe able to destroy nearly 4000 Soviet aircraft in 3 days of operation Barbarossa?

- 📝 How was the USA able to win naval battles in the Pacific?

- 📝 How was Israel able to build a powerful military within days of the formation of the state?

- 📝 How was King Henry VIII able to get syphilis?

- 📝 Did Andrew Jackson think the earth was flat?

- 📝 How was Alexander the Great able to rule so much territory?

- 📝 How was Switzerland able to stay neutral during WWI and WWII?

- 📝 How was Enguerrand VII de Coucy able to keep his allegiance to both king of England and France during the Hundred Years War?

- 📝 How was debt handled in the change over from the Julian calendar to the Gregorian?

- 📝 How was Hitler able to rearm?

- 📝 How was Australia able to start to demobilize in 1944?

- 📝 How was George III able to appoint William Pitt as his Prime Minister?

- 📝 How was Ivaylo's Bulgarian peasant army able to repel the Mongols?

- 📝 Which battle enabled Andrew Jackson to become the President of USA?

- 📝 What happened to UK national debt when the NHS was created?

- 📝 How was Herodotus able to get accounts of the Battle of Thermopylae?

- 📝 What Was the US Debt-To-GDP Before Jackson Was President

- 📝 Why did Frank James (Jesse's brother) get acquitted and how was he close with President Roosevelt despite being an outlaw?

- 📝 How was Napoleon able to take power from the Republic

- 📝 How were the Burmese able to sack Ayutthaya when it was one of the wealthiest and most powerful cities in Asia at the time?

- 📝 Why China was able to unify and not Europe?

- 📝 How was law enforcement handled in large US cities before professional police?

- 📝 How do ancient Chinese "mirrors" such as these in the National Museum function?

- 📝 How serious was Fermat's statement about the ancients?

- 📝 How and when was the modern company ownership structure invented?

- 📝 How long was a sea journey from England to East Africa 1868-1877?